Where Will the Service Robots Market Grow Fastest, and Why?

No longer confined to factories and warehouses, robots are quickly becoming part of our daily lives. Expectations are high for service robots, but what exactly are they, and where will consumers and businesses see and interact with them first?

Robots are typically classified based on their intended applications, with two broad categories being industrial robots and service robots. Service robots include automation designed to help people perform useful tasks. Variants include automated wheelchairs and household robots such as robotic vacuum cleaners.

Smart speakers such as Amazon Alexa/Echo and Google Home have led the way, but what is the state of the art in service robots, and what are the market prospects? Let’s examine examples of how you can get the most out of current service robots and where to look for new developments and uses.

Market analysis

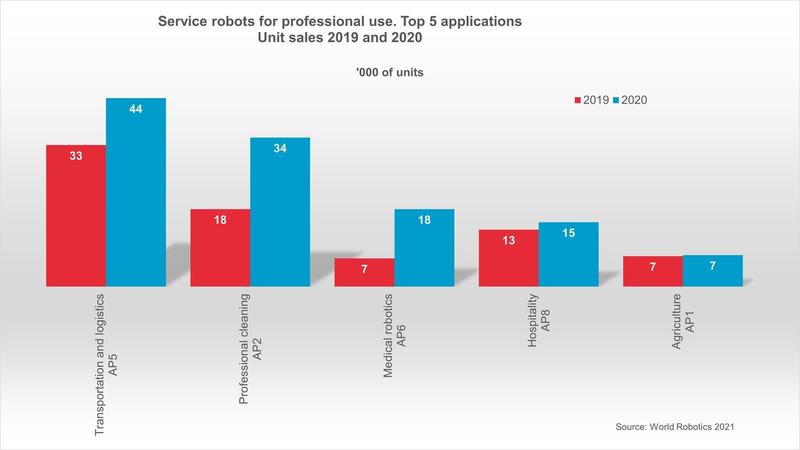

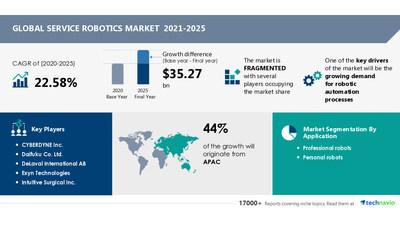

As the service robot market is relatively new, expectations are high for future growth. For example, a Northwest Trail study notes that the global service robotics market was valued at around $9 billion in 2016. The study predicts that it will reach approximately $24 billion in 2022, with a compound annual growth rate (CAGR) of almost 18% between 2017 and 2022.

Separately, a Grand View Research study projects that the global service robotics market will reach $15.7 billion by 2020. In addition, that market could grow to $23 billion by 2022, at a CAGR of just over 15%, according to MarketsandMarkets.

Estimates for the robotic vacuum cleaning market vary, but expectations are also high. The global robotic vacuum cleaner market was estimated to be about $3.4 billion in 2016, and it could grow to $7 billion by 2022 — a CAGR of about 13%, according to Research and Markets.

As far as the cleaning robot market, Research and Markets forecasts that it will grow from about $2 billion in 2018 to $4 billion by 2023 at a CAGR of about 16%.

According to Statista referencing the International Federation of Robotics (IFR), the market for robotics in personal and domestic applications will be dominated by robots cleaning floors and mowing the lawn for the next few years.

The IFR expects 31 million household robots to be sold between 2016 and 2019, 96% of which will be vacuum and floor-cleaning robots.

The market for household service robots will experience strong growth, according to the IFR.

The optimistic outlook for service robots is driven largely by increased government and commercial investments in the U.S. and Japan, as well as demand in markets such as defense and healthcare.

Identifying sources of demand, resistance

Even though innovations in sensors, navigation, and manipulation are occurring at a torrid pace, robotics developers and suppliers must fully identify the market needs and underlying demand.

Robot manufacturers such as iRobot, KUKA, Omron Adept, and Samsung are trying to determine what consumers and businesses truly want — and consequently can be monetized — as opposed to being intrigued with the “wow” factor but are not enough so to pay for these capabilities on a large scale.

The promised efficiency from deploying service robots can be a double-edged sword in terms of helping businesses but slowing adoption. Even though service robots are intended to take on tedious or difficult tasks, many observers have expressed concern about jobs for unskilled and semi-skilled human workers.

Particularly in the retail and food services industries, which are highly visible to consumers, a backlash could lead to increased regulation or reluctance to expand the use of robots.

To this point, recent research at Boston University offers insight into integrating the human element into companies’ robotics strategies. There are ample opportunities to consider the human factor in service robot development.

This means thinking beyond using automation for repetitive tasks. Robots can augment workers’ skills and create new types of jobs. This could be an example of using technology and human abilities for the betterment of both companies and their workers.

Which verticals could benefit most from service robots?

In addition to new applications for household robots driving demand, connectivity will generate data that can be used in new ways. In the Internet of Things (IoT), robots can interoperate with one another, connected homes, retailers, and other business systems.

The IFR defines service robots as devices that can operate “autonomously or semi-autonomously to perform services useful to the well-being of humans or equipment.”

Examples of some of the larger commercial service robot market segments include the following:

Some of the more prominent manufacturers of service robots include:

Some of the leading household vacuuming robot manufacturers include:

New areas for commercial robots

In addition to growing demand for robots in manufacturing and supply chains, opportunities are arising beyond vacuum cleaners. Household applications include mopping, pool-cleaning, and lawnmower robots.

Commercial uses of service robots include window cleaning, telepresence, and customer-relations machines. Some industry analysts see continued opportunities in service robots markets, particularly in commercial roles.

More on Service Robots:

When viewed in terms of market value, commercial and professional robots have the highest potential in terms of market potential, according to Grand View Research. It cited the logistics space.

More examples include delivery robots in offices or hospitals, firefighting robots, rehabilitation and surgical robots in hospitals, as well as robots for educational and research tasks.

Some commercial robots require a trained operator, who is responsible for starting, monitoring, and stopping them.

Robots are starting to augment humans through remotely operated infrastructure inspection and maintenance. With virtual reality (VR) and augmented reality (AR) controls, this segment should grow in the next two years.

Applications for service robots

Innovations continue as robot manufacturers like iRobot continue to identify market needs, both stated and unstated, for users in the robotics and consumer products industries. The company has sold more than 20 million robots worldwide. In addition to iRobot’s Roomba vacuuming robots, iRobot offers Braava mopping robots, and the Mirra pool-cleaning robots.

But iRobot is more than a developer and manufacturer of hardware. It is also developing technologies for mapping and navigation, as well as human-machine interaction. The company is building partnerships and internal initiatives to build an ecosystem of robots and data.

“The capabilities of today’s household robots extend beyond basic functionality like vacuuming to include the development, and enablement of, the connected home,” said Chris Jones, vice president of technology at iRobot.

He added that, in addition to current initiatives, “two to three years down the road, household robots will be an even more closely integrated part of the connected home.”

iRobot develops connectivity, interoperability

Interoperability with other connected devices is occurring. For example, all of iRobot’s connected Roomba robot vacuums are compatible with Google Assistant, Amazon Alexa, and IFTTT (If This Then That).

Figure 1: iRobot’s Clean Map Report

IFTTT allows users to create and use Applets that enable smart devices and services to communicate with one another. For example, “If my phone rings, pause Roomba.”

Other new features from iRobot include the ability to communicate with smartphones and other mobile devices. A good example of new features in the works at iRobot can be seen in Figure 1, which shows examples of Clean Map reports and Wi-Fi coverage maps.

With the Clean Maps report, customers can view cleaning coverage, as well as any areas of concentrated dirt on which the robot focused. Statistics are also available for such information as areas cleaned, job duration, and charging time for completed jobs.

iRobot’s Wi-Fi coverage map on smartphone

The Roomba 900-series vacuums can also detect Wi-Fi signal strength throughout a user’s home to highlight areas that may have poor connectivity. Users can then determine ways to fix the problems.

Upon start-up, the Roomba can collect Wi-Fi signal information as it cleans. Upon completion, users will receive a notification to view the Wi-Fi coverage map that was generated. They can then toggle between the Clean Map report and the Wi-Fi coverage map.

Use case example: iRobot Mirra pool-cleaning robot

iRobot’s Mirra pool-cleaning robot is another good example of how service robots can be designed to make life easier for users.

The system first approximates the size of the pool from the floor to the water line, then chooses the optimum cleaning cycle. The robot includes a self-contained vacuum, pump, filter system, and it uses a 60-foot floating power cord.

iRobot’s Mirra pool-cleaning robot

Mirra can pump and filter more than 4,000 gallons of water per hour, improving distribution of pool chemicals and heated water. It can also take some of the load off the main pool pump while it’s in use, resulting in reduced pump usage and energy savings.

Mirra makes passes while navigating obstacles and filtering out a wide range of impurities, objects, and bacteria as small as 2 microns. Unlike suction or pressure cleaners, the active scrubbing brush lifts dirt, algae, and bacteria off the pool floor and walls.

Conclusions and recommendations

While the world of robotics as a whole is advancing at a rapid pace for, the broad category of service robots is poised for explosive growth. This is especially true if we include capabilities ranging from household cleaning and retail to military roles, hazardous inspection services, and medicine delivery.

Today’s service robot manufacturers are striving to create products that consumers and commercial customers truly want and need. A top priority is innovation, of course, but users need robots that are easy to use, relevant for specific markets, and offer a compelling return on investment and unique value proposition.

Technology advances go beyond hardware to include interoperability with connected homes and businesses. In IoT, data can be shared with, and across, various robots and other machines, devices, and equipment that are integral parts of a home or business IT vast infrastructure.

At the heart of the mission of service robots is the human element of such innovations. The downside of increased efficiencies from automation is the threat to people’s job roles and livelihoods. The debate over whether robots will eliminate or create jobs continues.

Not to be forgotten is the end-user experience, which often thrives with a mix of both technology and touch. For progressive firms, searching for ways to maximize efficiencies, deploying service robots while adding a human touch can create a balance that can work on multiple levels.